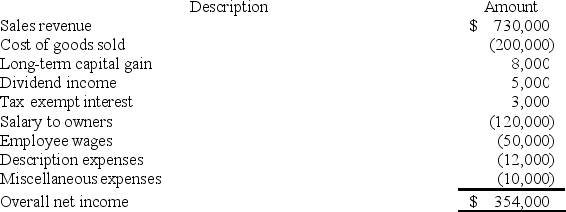

XYZ Corporation (an S corporation)is owned by Jane and Rebecca who are each 50% shareholders.At the beginning of the year,Jane's basis in her XYZ stock was $40,000.XYZ reported the following tax information for 2017.

Required:

Required:

a.What amount of ordinary business income is allocated to Jane?

b.What is the amount and character of separately stated items allocated to Jane?

c.What is Jane's basis in her XYZ corp.stock at the end of the year?

Definitions:

Bisexuals

Individuals who are sexually attracted to both men and women.

Sexual Identity

An individual's personal sense of their own sexuality, which may include elements such as sexual orientation, preferences, and gender identity.

Gay Power Movement

A social and political movement advocating for the rights and empowerment of LGBTQ+ individuals.

Same-sex Orientation

A romantic or sexual attraction to individuals of the same sex.

Q23: Amy transfers property with a tax basis

Q38: Madrid Corporation is a 100 percent owned

Q40: Kim received a 1/3 profits and capital

Q57: Assume Congress reduces the corporate tax rate

Q61: April transferred 100 percent of her stock

Q79: Emerald Corporation is a 100 percent owned

Q80: Clampett,Inc.has been an S corporation since its

Q88: A disadvantage of a sole proprietorship is

Q96: A serial gift strategy consists of arranging

Q113: S corporation shareholders are not allowed to