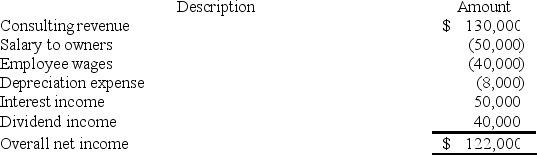

RGD Corporation was a C corporation from its inception in 2013 through 2016.However,it elected S corporation status effective January 1,2017.RGD had $50,000 of earnings and profits at the end of 2016.RGD reported the following information for its 2017 tax year.

What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

Definitions:

Payoff Matrix

A table that shows the potential outcomes of different strategies in a competitive situation.

Christmas Gifts

Items specifically purchased or made to be given to someone during the Christmas holidays as a form of expressing affection or appreciation.

Publicly Announce

To declare or state something in a public forum or through media accessible to the general public.

Thanksgiving

Primarily a holiday celebrated in the United States, symbolizing gratitude and harvest, but not a standard economic term.

Q19: Marlin Corporation reported pretax book income of

Q19: The Federal transfer taxes are calculated using

Q28: Daniela is a 25% partner in the

Q40: A partner recognizes gain when he receives

Q53: An S corporation election may be voluntarily

Q59: Shauna is a 50% partner in the

Q87: The United States generally taxes U.S.sourced fixed

Q99: Zhao incorporated her sole proprietorship by transferring

Q112: Hazel is the sole shareholder of Maple

Q214: A _ is a business that is