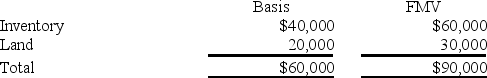

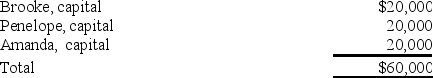

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000.BPA reports the following balance sheet:

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

b.Are these assets "hot" for purposes of distributions?

c.If BPA distributes the land to Brooke in complete liquidation of her partnership interest,what tax issues should be considered?

Definitions:

Profit

The difference between what it costs to make and sell a product and what a customer pays for it.

Q13: Ruby's tax basis in her partnership interest

Q15: Ricardo transferred $1,000,000 of cash to State

Q16: Abbot Corporation reported pretax book income of

Q20: Taxable income of the most profitable corporations

Q27: Before subpart F applies,a foreign corporation must

Q28: During 2017,MVC operated as a C corporation.However,it

Q30: In each of the independent scenarios below,how

Q54: A distribution in partial liquidation of a

Q57: Assume Congress reduces the corporate tax rate

Q87: Delivery of tangible personal property through common