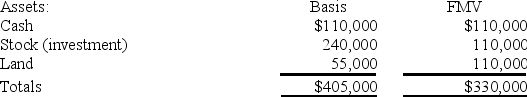

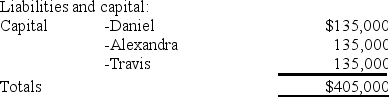

Daniel's basis in the DAT Partnership is $135,000.DAT distributes its land to Daniel in complete liquidation of his partnership interest.DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Job Order Cost System

An accounting system that accumulates costs by specific jobs, used in situations where goods or services are produced upon receipt of a customer order.

Cost Of Production Report

A detailed report that outlines the costs associated with the production of goods, including direct materials, direct labor, and overhead.

Job Cost Cards

Documents used to record and track the costs associated with a specific job or project, including materials, labor, and overhead.

Work In Process Inventory

Inventory that includes all the materials, labor, and overhead costs for products that are in the production process but not yet complete.

Q4: Weber Corporation reported pretax book income of

Q16: The Canadian government imposes a withholding tax

Q41: Most state tax laws adopt the federal

Q41: Battle Corporation redeems 20 percent of its

Q49: Davison Company determined that the book basis

Q55: Green Corporation has current earnings and profits

Q56: Which of the following statements best describes

Q59: On June 12,20X9,Kevin,Chris,and Candy Corp.came together to

Q84: Bob is a general partner in Fresh

Q97: Abbot Corporation reported a net operating loss