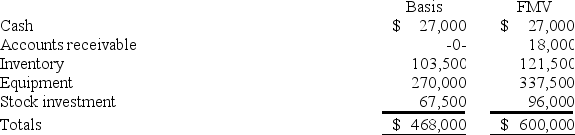

Zayde is a 1/3 partner in the ARZ partnership with an outside basis of $156,000 on January 1.Zayde sells his partnership interest to Thomas on January 1st for $180,000 cash.The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased 3 years ago.What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased 3 years ago.What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Definitions:

Emotional Intelligence

The ability to perceive, control, and evaluate emotions in oneself and others, often linked to success in personal and professional relationships.

Genetic Endowment

The set of genes and genetic information that individuals inherit from their parents at conception.

Racialized Differences

The process by which societies categorize individuals into racial groups and attribute specific characteristics and disparities to these categorizations.

Perceived Intelligence

The level of intelligence an individual is thought to have by others, which may influence their social interactions and opportunities.

Q2: In the sale of a partnership interest,a

Q14: Suppose at the beginning of 2017,Jamaal's basis

Q14: Federico is a 30% partner in the

Q29: The state tax base is computed by

Q29: Jackson is the sole owner of JJJ

Q53: ASC 740 applies a two-step process in

Q69: Mike and Michelle decided to liquidate their

Q69: Brown Corporation reports $100,000 of gain from

Q75: Ken and Jim agree to go into

Q140: Over what time period do corporations amortize