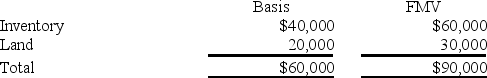

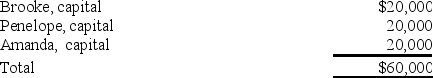

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000.BPA reports the following balance sheet:

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

b.Are these assets "hot" for purposes of distributions?

c.If BPA distributes the land to Brooke in complete liquidation of her partnership interest,what tax issues should be considered?

Definitions:

European Hegemony

The political, economic, or cultural dominance of European nations over other regions, notably during the colonial and imperial periods.

World Leaders

Individuals who hold significant political power and influence in countries or global organizations.

Isolationism

The desire to avoid foreign entanglements that dominated the U.S. Congress in the 1930s; beginning in 1935, lawmakers passed a series of Neutrality Acts that banned travel on belligerents’ ships and the sale of arms to countries at war.

International Conflicts

Disputes between different countries or nations, which can involve military, economic, or diplomatic disagreements and can escalate to war.

Q13: Corporation A receives a dividend from Corporation

Q54: A distribution in partial liquidation of a

Q68: ASC 740 permits a corporation to net

Q71: Which of the following tax or non-tax

Q73: Which of the following is allowable as

Q82: Clampett,Inc.has been an S corporation since its

Q85: Which statement best describes the U.S.framework for

Q89: Which of the following statements about ASC

Q95: Cash distributions include decreases in a partner's

Q97: Abbot Corporation reported a net operating loss