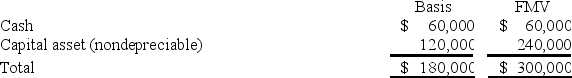

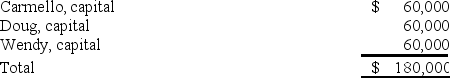

Carmello is a one-third partner in the CDW Partnership with equal inside and outside bases.On December 31,Carmello sells his interest to Conrad for $100,000 cash.CDW makes a §754 election and its balance sheet as of December 31 is as follows:

What is the amount of Conrad's special basis adjustment? If CDW sells the capital asset next year for $300,000,what is the amount of gain Conrad will recognize because of the sale?

What is the amount of Conrad's special basis adjustment? If CDW sells the capital asset next year for $300,000,what is the amount of gain Conrad will recognize because of the sale?

Definitions:

Stimulus

Any event or situation that evokes a response from an organism.

Sensory Apparatus

The complex of sensory organs and parts an organism uses to detect changes in its environment.

Vestibular Receptors

are sensory receptors in the inner ear responsible for detecting movement and changes in the position of the head, important for balance and spatial orientation.

Body Position

The posture or arrangement of the body and its limbs, which can influence various physiological and psychological processes.

Q1: Which of the following principles does not

Q36: Which of the following statements best describes

Q57: Use tax liability accrues in the state

Q59: Unlike partnerships,adjustments that decrease an S corporation

Q60: Evergreen Corporation distributes land with a fair

Q63: Tristan transfers property with a tax basis

Q73: Evergreen Corporation distributes land with a fair

Q75: At his death,Jose owned real estate worth

Q86: Which of the following is prohibited from

Q89: For partnership tax years ending after December