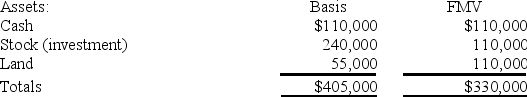

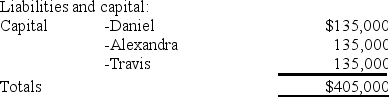

Daniel's basis in the DAT Partnership is $135,000.DAT distributes its land to Daniel in complete liquidation of his partnership interest.DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Color Choices

Refers to the selection of colors used in various contexts, including design, marketing, and personal preferences, often influencing mood and perception.

Price Objections

Resistance or hesitation from a potential customer based on the cost of a product or service, requiring effective negotiation and value demonstration by the seller.

Forestalling

Forestalling in sales involves anticipating potential objections or issues before they are raised by the customer, and addressing them proactively.

Q6: Boca Corporation,a U.S.corporation,reported U.S.taxable income of $1,000,000

Q11: The generation-skipping tax is designed to accomplish

Q32: The definition of property as it relates

Q37: Income earned by flow-through entities is usually

Q47: In January 2016,Khors Company issues nonqualified stock

Q55: In general,a temporary difference reflects a difference

Q97: As part of its uncertain tax position

Q98: Stock dividends are always tax-free to the

Q120: For S corporations with earnings and profits

Q128: At the beginning of the year,Clampett,Inc.had $100,000