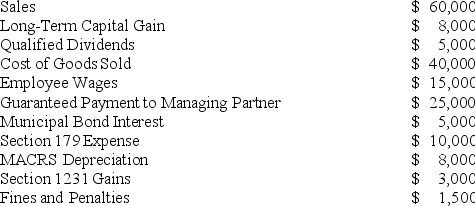

Illuminating Light Partnership Had the Following Revenues,expenses,gains,losses,and Distributions

Illuminating Light Partnership had the following revenues,expenses,gains,losses,and distributions:

Given these items,what is Illuminating Light's ordinary business income (loss)for the year?

Given these items,what is Illuminating Light's ordinary business income (loss)for the year?

Definitions:

Personal Exemption Rate

A tax deduction that a taxpayer is entitled to claim for themselves and any dependents, reducing the taxable income.

Capital Gains Tax

A tax on the profit realized from the sale of a non-inventory asset that was purchased at a cost amount that was lower than the amount realized on the sale.

Marginal Tax Rate

The percentage of tax applied to your next dollar of income, reflecting the tax bracket into which the last dollar of taxable income falls.

Corporate Tax System

The structure by which businesses are taxed by the government on their profits, incorporating varying rates and regulations depending on the country or jurisdiction.

Q2: What was the Supreme Court's holding in

Q13: Half Moon Corporation made a distribution of

Q19: In certain circumstances,C corporations can elect to

Q35: Jessica is a 25% partner in the

Q39: Esther and Elizabeth are equal partners in

Q43: Gary and Laura decided to liquidate their

Q44: Which of the following statements is true

Q59: Unlike partnerships,adjustments that decrease an S corporation

Q103: What was the Supreme Court's holding in

Q135: TrendSetter Inc.paid $50,000 in premiums for life