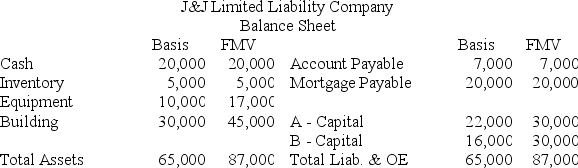

J&J,LLC was in its third year of operations when J&J decided to expand the number of members from two,A & B,with equal profits and capital interests to three members,A,B,and C.The third member,C,will contribute her financial expertise to the LLC in exchange for a 1/3 capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted,what are the tax consequences to members A,B,and C,and to J&J when C receives her capital interest? If,instead,member C receives a 1/3 profit interest,what would be the tax consequences to members A,B,and C,and to J&J?

Definitions:

Whistle-Blower

An individual who exposes illegal or unethical activities within a public or private organization.

Pfizer

A multinational pharmaceutical corporation known for developing a wide range of medicines and vaccines, including treatments for COVID-19.

Fraud Case

A legal or regulatory proceeding involving allegations of dishonest practices, such as embezzlement or deceit for personal or financial gain.

Ethics Codes

A set of guidelines designed to help professionals conduct business honestly and with integrity.

Q1: Hanover Corporation,a U.S.corporation,incurred $300,000 of interest expense

Q18: Jaime has a basis in her partnership

Q25: Assume Joe Harry sells his 25% interest

Q51: Which of the following statements regarding disproportionate

Q68: ASC 740 permits a corporation to net

Q70: A §754 election is made by a

Q84: Gordon operates the Tennis Pro Shop in

Q91: Which of the following statements best describes

Q94: Juan transferred 100 percent of his stock

Q118: An S corporation can make a voluntary