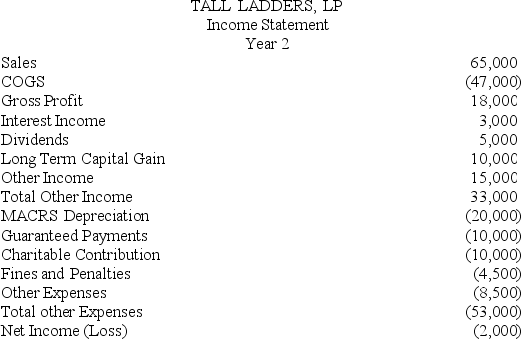

At the end of year 1,Tony had a tax basis of $40,000 in Tall Ladders,Limited Partnership.Tony has a 20 percent profits interest in Tall Ladders.For year 2,Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership.Given the following Income Statement and Balance Sheet from Tall Ladders,what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Laboratory Observation

A research method where subjects are observed in a controlled environment to minimize external variables.

Naturalistic Observation

A research method in which subjects are observed in their natural environment without any manipulation by the observer.

Research Study

A systematic investigation, including research development, testing, and evaluation, designed to develop or contribute to generalizable knowledge.

Standardized Test

A test administered and scored in a consistent manner to ensure reliability and validity across all test takers.

Q14: Tennis Pro,a Virginia Corporation domiciled in Virginia,has

Q14: Viking Corporation is owned equally by Sven

Q21: Boston,Inc.made a capital contribution of investment property

Q34: What tax year-end must an unincorporated entity

Q56: When an S corporation distributes appreciated property

Q64: After terminating or voluntarily revoking S corporation

Q72: Which of the following businesses is likely

Q74: In what order are the loss limitations

Q85: Austin Company reports positive current E&P of

Q90: Packard Corporation reported taxable income of $1,000,000