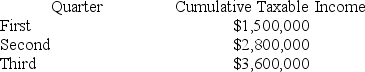

In the current year,Auto Rent Corporation reported the following taxable income at the end of its first,second,and third quarters: (Use Exhibit 5-11)

What amount of estimated tax payments would Auto Rent pay each quarter in order to avoid estimated tax penalties under the annualized income method of computing estimated tax payments? (Use Corporate Tax Rate Schedule.)

What amount of estimated tax payments would Auto Rent pay each quarter in order to avoid estimated tax penalties under the annualized income method of computing estimated tax payments? (Use Corporate Tax Rate Schedule.)

Definitions:

Release from Liability

A legal document that absolves one party from responsibility for any injuries or damages suffered by another party.

Organizational Announcements

Official messages distributed to members within an organization, often related to policy changes, new hires, promotions, or other significant updates.

Negative

Referring to something harmful, undesirable, or expressing disapproval or pessimism.

Performance Problems

Issues related to an employee's work performance that do not meet the established standards or expectations.

Q10: Roberto and Reagan are both 25 percent

Q12: What is the rationale for the specific

Q15: Which of the following best describes the

Q29: Which of the following is likely to

Q29: C corporations and S corporations are separate

Q40: Comet Company is owned equally by Pat

Q41: If a corporation's cash charitable contributions exceed

Q69: Brown Corporation reports $100,000 of gain from

Q73: Which of the following items is NOT

Q103: Which of the following describes the correct