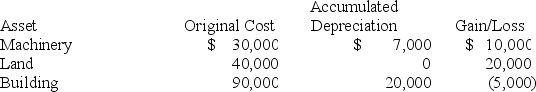

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last 5 years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Geographical Border

A naturally or artificially designated boundary separating distinct areas, countries, or territories.

Cultural Border

An invisible boundary based on cultural differences that separate areas or people, influencing identity, customs, and practices.

Plains Indians

Native American peoples who inhabited the Great Plains of the United States and Canada, known for their nomadic lifestyles and reliance on the buffalo.

Small Horses

Generally refers to horse breeds that are smaller in size, often including miniature horses and ponies.

Q3: Describe causes of the bullwhip effect.

Q37: Demand for an item is 20 units

Q46: A computerized inventory system checks inventory levels

Q49: For book purposes,RadioAircast Inc.reported $15,000 of income

Q50: Keegan incorporated his sole proprietorship by transferring

Q68: According to the Internal Revenue Code §162,deductible

Q74: The gain or loss realized on the

Q75: Au Sable Corporation reported taxable income of

Q80: Only half the cost of a business

Q126: Which of the following is not calculated