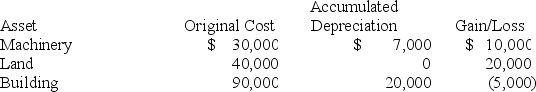

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last 5 years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Petroleum

A naturally occurring, yellowish-black liquid found in geological formations beneath the Earth's surface, used primarily as a fuel source.

Per Capita Water Use

The average amount of water used per person within a specific population or area over a certain time frame.

Renewable Energy Sources

Energy sources that are replenished naturally, such as solar, wind, hydro, and geothermal power.

Electricity Generation

The process of producing electrical power from various energy sources, including fossil fuels, nuclear power, and renewable resources.

Q1: Service levels are<br>A) the percentage of time

Q2: A company has sales of $150 million,cost

Q2: Joe is a self-employed electrician who operates

Q19: Which of the following is an explanation

Q32: MAC,Inc.completed its first year of operations with

Q58: A decrease in an item's lead time

Q62: Which of the following is a true

Q71: Bull Run sold a computer for $1,200

Q101: What is the primary purpose of a

Q116: Corporations may carry excess charitable contributions forward