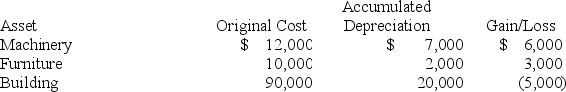

Andrew,an individual,began business four years ago and has never sold a §1231 asset.Andrew owned each of the assets for several years.In the current year,Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 30 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 30 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Physical Exercise

Any physical activity that improves or sustains physical health and overall well-being.

Terminal Decline

The phenomenon of accelerated deterioration of cognitive and physical function closely preceding death.

Mental Ability

Refers to the capacity to perform cognitive tasks, solve problems, and learn from experience, often assessed through intelligence tests.

Death

The cessation of all biological functions that sustain a living organism.

Q10: Given that unit item cost = $30,annual

Q22: Which of the following statements is NOT

Q27: In order to deduct a portion of

Q35: ASC 740 requires a publicly traded company

Q53: Which of the following statements is NOT

Q58: Tatoo Inc.reported a net capital loss of

Q73: Which of the following items is NOT

Q91: The IRS would most likely apply the

Q96: Superior Corporation reported taxable income of $1,000,000

Q139: NOL and capital loss carryovers are deductible