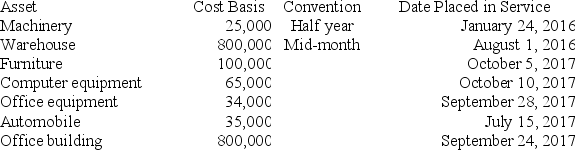

Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2016 and 2017:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Definitions:

Dred Scott Decision

A landmark 1857 Supreme Court case that held African Americans, whether enslaved or free, could not be American citizens and therefore had no standing to sue in federal court, and that the federal government had no power to regulate slavery in the federal territories acquired after the creation of the United States.

James McCune Smith

The first African American to hold a medical degree and an influential abolitionist and author in the 19th century America.

John McLean

A prominent figure in U.S. history, often associated with his role as a justice on the Supreme Court or his contributions to American political and legal systems.

Q7: Project managers can accept some (minimal)slack on

Q8: In general,it is extremely difficult to estimate

Q14: If the critical ratio of a job

Q20: Which of the following transportation modes has

Q24: Gainesville LLC sold the following business assets

Q27: Purchasing activities include<br>A) choosing suppliers.<br>B) negotiating contracts.<br>C)

Q43: Don operates a taxi business,and this year

Q75: Realized gains are recognized unless there is

Q104: Sairra,LLC purchased only one asset during the

Q109: ValuCo gives you the following information:<br> <img