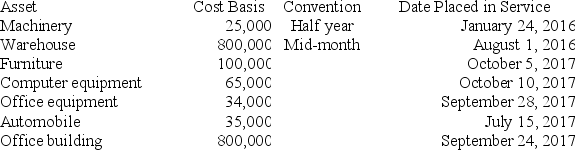

Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2016 and 2017:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Definitions:

Average Number

A value found by summing a set of numbers and then dividing by the count of numbers in the set.

Employees

Individuals who are hired by a business or organization to perform specific tasks in exchange for compensation.

GST Remittance

This is the process of sending the collected Goods and Services Tax to the governing tax authority.

GST Returns

The periodic filing with the taxation authority detailing sales, the GST collected on sales, and the GST paid on purchases.

Q31: Consider the following statements regarding supplier relationship

Q37: Coop Inc.owns 40% of Chicken Inc.,both Coop

Q43: Which of the following statements regarding net

Q49: Significant limits are placed on the depreciation

Q50: Corporations are legally better suited for taking

Q54: Corporations are not allowed to deduct charitable

Q55: Illegal bribes and kickbacks are not deductible

Q59: In 2014,Smith Traders Inc.reported taxable income of

Q68: Volos Company (a calendar-year corporation)began operations in

Q102: A corporation with an AMTI of $400,000