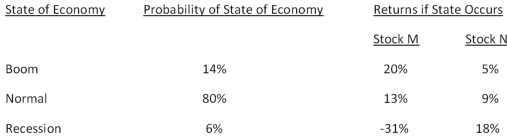

What is the expected return on a portfolio comprised of $6,200 of stock M and $4,500 of stock N if the economy enjoys a boom period?

Definitions:

Nominal Variables

Variables measured in monetary terms and not adjusted for inflation, representing prices or values at the time of transaction.

Monetary Neutrality

The economic theory that changes in the money supply only affect nominal variables and have no long-term effects on real variables like output.

Real Variables

Economic variables that are measured in physical units or have been adjusted for inflation, emphasizing their true value.

Quantity Theory

An economic theory which proposes that changes in the money supply will directly affect price levels in the economy over the long term.

Q2: Which one of the following statements is

Q4: The date on which a shareholder is

Q5: Which one of the following dates is

Q23: Atlas Corp.wants to raise $4 million via

Q26: Bakers' Town Bread is selling 1,200

Q42: The absolute priority rule determines:<br>A)when a firm

Q46: Which one of the following statements is

Q46: If a project has a net present

Q65: Textile Mills borrows money at a rate

Q78: Western Wear is considering a project that