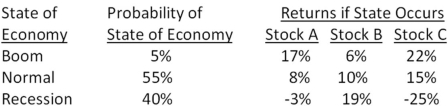

What is the standard deviation of the returns on a portfolio that is invested in stocks A,B,and C? Twenty five percent of the portfolio is invested in stock A and 40 percent is invested in stock C.

Definitions:

Inverse Demand

A mathematical representation of demand that expresses price as a function of quantity demanded, typically showing how the price will adjust to achieve market equilibrium.

Cournot Duopolists

Firms in a duopoly (a market with only two producers) following Cournot competition, where each firm decides its production level assuming the other's decision as given.

Total Cost

The complete cost of producing a specific number of goods or services, including both fixed and variable costs.

Bean Sprouts

Edible sprouts derived from the germination of beans, commonly used in Asian cuisine.

Q35: Which of the following are correct according

Q37: A stock had the following prices

Q55: One year ago,you purchased 500 shares of

Q65: Textile Mills borrows money at a rate

Q70: The dividend growth model can be used

Q82: Lester's Frozen Foods just paid out $0.50

Q86: The Thunder Dan's Corporation's purchases from

Q87: Henessey Markets has a growth rate of

Q94: By definition,which one of the following must

Q95: All else equal,the market value of a