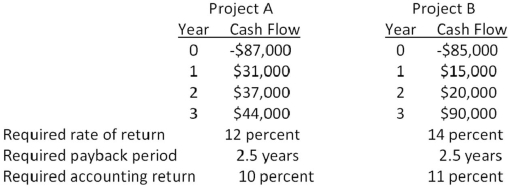

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

Definitions:

Q5: Which one of the following best describes

Q18: Rossiter Restaurants is analyzing a project that

Q20: Which one of the following types of

Q41: Which one of the following is the

Q45: Forty years ago,your mother invested $5,000.Today,that investment

Q47: You want to buy a new sports

Q91: Morristown Industries has an issue of preferred

Q101: You are scheduled to receive annual payments

Q108: The equivalent annual cost method is useful

Q129: Your grandfather left you an inheritance that