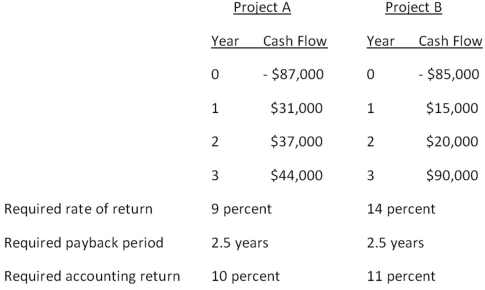

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on net present value analysis?

Should you accept or reject these projects based on net present value analysis?

Definitions:

Q20: Which one of the following statements is

Q25: Jerilu Markets has a beta of 1.09.The

Q32: Which one of the following statements related

Q43: Kaiser Industries has bonds on the market

Q52: You expect to receive $9,000 at graduation

Q63: Which one of the following statements concerning

Q66: Calculate the standard deviation of the following

Q107: Nelson Mfg.owns a manufacturing facility that is

Q116: On the day you entered college you

Q125: What is the effective annual rate if