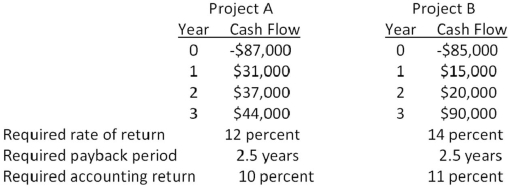

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

Definitions:

Variance

The measure of how spread out numbers are in a dataset, calculated as the average of the squared differences from the mean.

Analysis of Variance

A statistical method used to compare means of three or more samples by analyzing variance among and between data groups to identify any statistically significant differences.

Treatment Means

The average outcomes or results of different treatments or conditions in experimental research.

Sample Mean

The average value of a set of characteristics (numbers) from a subset of a population, used to estimate the population mean.

Q2: Boston Chicken is considering two mutually

Q6: Roger's Meat Market is considering two independent

Q19: A stock had returns of 16 percent,4

Q28: Your firm is contemplating the purchase of

Q45: Thayer Farms stock has a beta of

Q57: You are considering two independent projects with

Q66: Calculate the standard deviation of the following

Q69: Treasury bonds are:<br>A)issued by any governmental agency

Q70: You are purchasing a 20-year,zero-coupon bond.The yield

Q84: You have just purchased a new warehouse.To