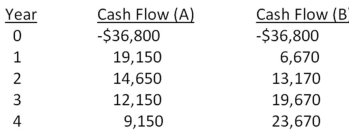

Hungry Hoagie's has identified the following two mutually exclusive projects:

At what rate would you be indifferent between these two projects?

Definitions:

Per Share FCFE

Free Cash Flow to Equity (FCFE) calculated on a per-share basis, indicating the amount of cash available to shareholders per share.

Required Return

The minimum expected return by investors for investing in a risky asset, considering the risk level compared to the risk-free rate.

Per Share FCFE

Free Cash Flow to Equity per share, which indicates how much cash is available to the equity shareholders of a company after all expenses and reinvestments.

Required Return

The minimum expected return an investor demands for investing in a particular asset, considering its risk.

Q35: Sales can often increase without increasing which

Q38: Blasco Industries is currently at full-capacity sales.Which

Q38: You own a portfolio that has $2,000

Q51: Explain the conditions that would need to

Q54: The bid price is:<br>A)an aftertax price.<br>B)the aftertax

Q56: Your employer contributes $50 a week to

Q58: Which one of the following risks would

Q75: Explain the difference between systematic and unsystematic

Q76: Martin Aerospace is currently operating at full

Q125: A newly issued bond has a 7