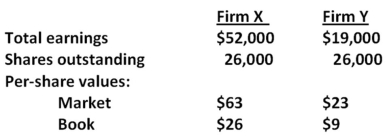

Consider the following premerger information about Firm X and Firm Y:  Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

Definitions:

Net Disbursement Float

The time difference between when a check is issued by a company and when the funds are actually withdrawn from the company's bank account.

Outstanding Checks

Checks that have been written and recorded in the account ledger but not yet cashed or cleared by the bank.

Availability Delay

The delay between the time a deposit is made into a bank account and the time those funds become accessible.

Mailing Time

The duration between when a mailpiece is sent and when it is received.

Q4: Which of the following represent cash outflows

Q9: Which of the following are current assets?<br>I.patent<br>II.inventory<br>III.accounts

Q11: A firm wishes to maintain a growth

Q16: The Sweet Shoppe and Candy Land are

Q19: A business partner whose potential financial loss

Q20: Consider the following information for Kaleb's Kickboxing:

Q33: Give an example of a protective put

Q43: The primary purpose of a flip-in provision

Q66: You are scheduled to receive $30,000 in

Q91: Several rumors concerning Value Rite stock are