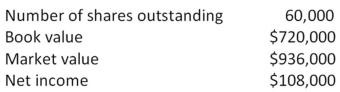

Underwater Experimental is considering a project which requires the purchase of $498,000 of fixed assets.The net present value of the project is $22,500.Equity shares will be issued as the sole means of financing the project.What will the new book value per share be after the project is implemented given the following current information on the firm?

Definitions:

IRR

Internal Rate of Return (IRR) is a financial measure used to evaluate the profitability of potential investments by calculating the interest rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equals zero.

Initial Cost

The initial outlay or expenditure associated with the purchase or acquisition of an asset, not including ongoing operating or maintenance costs.

Revenue

The total amount of income generated by the sale of goods or services related to a company's primary operations.

MIRR

Modified Internal Rate of Return, a financial metric that addresses some of the limitations of the traditional internal rate of return by taking into account different financing and reinvestment rates.

Q18: Jungle,Inc.has a target debt-equity ratio of 0.72.Its

Q22: Miller Sisters has an overall beta of

Q23: The weighted average cost of capital for

Q35: Lockboxes:<br>A)should be geographically located close to a

Q36: Which of the following are uses of

Q42: You own a portfolio equally invested in

Q59: The Pizza Palace has a cost of

Q67: The Wake-Up Coffee Company has projected the

Q78: Davis and Davis have expected sales of

Q96: The last date on which you can