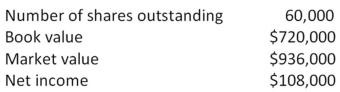

Underwater Experimental is considering a project which requires the purchase of $498,000 of fixed assets.The net present value of the project is $22,500.Equity shares will be issued as the sole means of financing the project.What will the new book value per share be after the project is implemented given the following current information on the firm?

Definitions:

CCA

Capital Cost Allowance; a tax deduction in Canada for the depreciation of tangible property.

Earnings Before Interest And Taxes

A measure of a firm's profit that includes all income and expenses except interest and income tax expenses.

Retained Earnings

The portion of a company's profits that is kept or retained rather than distributed to shareholders or owners as dividends.

Net New Equity

The amount of equity capital a company raises through the issuance of new shares minus any shares it has bought back, reflecting the net increase in share capital.

Q10: Explain how a firm loses value during

Q10: What is a prospectus?<br>A)a letter issued by

Q12: The expected return on a stock computed

Q14: Barstow Industrial Supply has decided to raise

Q16: New York Bank provides Food Canning,Inc.a $250,000

Q30: Wear Ever is expanding and needs $12.6

Q41: You are considering the purchase of a

Q58: Which one of the following statements is

Q87: What role does the weighted average cost

Q108: The expected rate of return on a