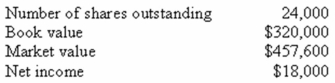

The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations.Some recent financial information for the company is shown here:  MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000,and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000,and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

Definitions:

Secured Obligation

A debt or other type of financial obligation that is backed by collateral to reduce the risk of non-payment.

Secured Party

A lender or creditor in a secured transaction who has a legal interest in the collateral offered by the borrower.

Party Owes

This term suggests the existence of a debt or obligation that one individual or entity holds towards another.

Redevelopment Capital

Funds allocated for investing in the improvement and revitalization of existing areas or structures, typically for economic growth.

Q28: Brustle's Pottery either factors or assigns all

Q43: Which type of analysis identifies the variable,or

Q44: Which one of the following statements concerning

Q61: Kid's Delight expects to sell $8,200 worth

Q75: Peterborough Trucking just purchased some fixed assets

Q79: The market has an expected rate of

Q81: You recently purchased a stock that is

Q87: You want to invest in an index

Q94: Assume that the returns from an asset

Q103: Which one of the following will increase