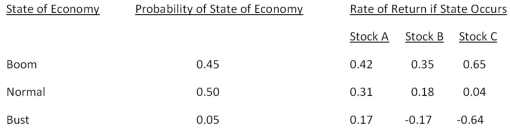

Consider the following information on three stocks:  A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

Definitions:

Materials Price Variance

The difference between the actual amount paid for materials and the expected (or standard) cost of those materials, multiplied by the quantity of materials purchased.

Direct Material Standards

Standard costs set for the quantity and price of materials required for a manufacturing process.

Purchases Variance

A measurement of the difference between the actual cost of materials and the expected, or standard, cost.

Variable Overhead Efficiency Variance

The difference between the actual variable overhead costs incurred and the standard costs for the actual production volume.

Q2: What is the expected return on a

Q12: The Turtle Cave currently has 160,000 shares

Q30: Standard deviation is a measure of which

Q41: The discount rate assigned to an individual

Q48: Which two methods of project analysis are

Q56: Precision Tool is analyzing two machines to

Q59: The pre-tax cost of debt:<br>A)is based on

Q62: Which of the following tends to increase

Q91: Bankruptcy:<br>A)creates value for a firm.<br>B)transfers value from

Q102: Which one of the following is a