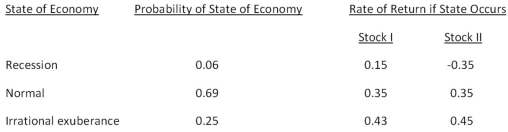

Consider the following information on Stocks I and II:  The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

Definitions:

Net Present Value (NPV)

A calculation used to assess the profitability of an investment, measuring the difference between the present value of its cash inflows and outflows.

Internal Rate of Return (IRR)

The rate of growth a project is expected to generate, calculated as the discount rate that makes the net present value (NPV) of all cash flows equal to zero.

Payback Method

An investment analysis method that calculates the time required to recoup the cost of an investment, based on the cash flow it generates.

Capital Cost Allowance (CCA)

The Canada Revenue Agency’s term for depreciation when calculating taxes.

Q14: Kwik 'n Hot Dogs is considering the

Q18: The total direct costs of underwriting an

Q55: Upper Crust Bakers just paid an annual

Q59: The relevant discount rate for the following

Q69: Mr.Bear,your boss,will only agree to accept a

Q78: The returns on the common stock of

Q81: Which one of the following categories of

Q85: Kelso Electric is debating between a leveraged

Q88: You are considering the following two mutually

Q93: In general,the capital structures used by U.S.firms:<br>A)tend