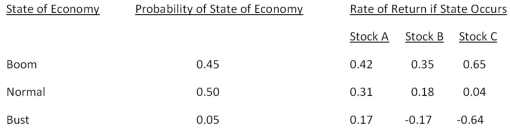

Consider the following information on three stocks:  A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

Definitions:

Pair of Equations

Two mathematical equations set up in relation to each other, often used to find the values of two unknown variables by solving them simultaneously.

Graphically

In a manner that uses diagrams, charts, maps, or other visual representations to explain or illustrate.

Set of Equations

A group of equations that are solved together, where each equation may have multiple variables.

Graphically

Representing data or information using visual elements such as charts, graphs, or diagrams.

Q17: Johnson Tire Distributors has debt with both

Q37: Which of the following apply to a

Q43: A stock had annual returns of 3.6

Q45: Young's Home Supply has a debt-equity ratio

Q53: A stock had returns of 14 percent,13

Q55: What was the average rate of inflation

Q63: Richard has an outstanding order with his

Q67: The expected return on a stock given

Q96: Which one of the following is the

Q99: Which one of the following dates is