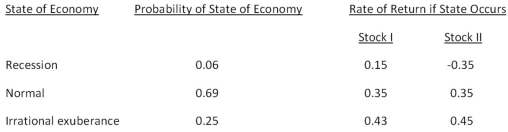

Consider the following information on Stocks I and II:  The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

Definitions:

James Olds

A neuroscientist known for his discovery of the brain's reward system and its effects on behavior.

Applied Psychology

The use of psychological principles and theories to overcome problems in real-life situations, such as in business, education, or mental health.

World War II

A global conflict lasting from 1939 to 1945, involving most of the world's nations and marked by significant events including the Holocaust and the use of atomic bombs.

Brain Hemispheres

The two halves of the brain, the left and right hemispheres, each responsible for different functions and skills.

Q5: Which one of the following best describes

Q10: You are analyzing a project and have

Q18: Douglass & Frank has a debt-equity ratio

Q22: The 40-day period following an IPO during

Q37: Which one of the following is an

Q50: A stock split:<br>A)increases the total value of

Q59: Which of the following statements is correct

Q64: Roger's Meat Market is considering two independent

Q89: Which one of the following is the

Q114: You are considering two independent projects with