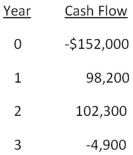

You are considering an investment with the following cash flows.If the required rate of return for this investment is 15.5 percent,should you accept the investment based solely on the internal rate of return rule? Why or why not?

Definitions:

Initial Value Method

An accounting approach where investments are recorded at their purchase cost without subsequent adjustments for changes in market value.

Intra-entity Gross Profit

The gross profit resulting from transactions within the same company or between parent and subsidiary companies, which may need to be eliminated in consolidated financial statements.

Consolidation Worksheet

A tool used in preparation of consolidated financial statements that helps combine the financials of a parent company and its subsidiaries.

Goodwill

An intangible asset on a company's balance sheet representing the premium paid over the book value of the assets acquired in a merger or acquisition.

Q16: A project that provides annual cash flows

Q19: Your coin collection contains fifty-four 1941 silver

Q31: Blue Water Systems is analyzing a project

Q32: Fourteen years ago,your parents set aside $7,500

Q41: You are the beneficiary of a life

Q46: Assume you graph a project's net present

Q54: A Treasury bond is quoted at a

Q89: Which of the following statements are true

Q110: Which one of the following terms is

Q111: You have $5,600 that you want to