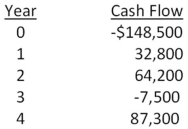

Cool Water Drinks is considering a proposed project with the following cash flows.Should this project be accepted based on the combined approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 12.6 percent? Why or why not?

Definitions:

GIC

A financial product in Canada known as a Guaranteed Investment Certificate that promises a specific return rate for a predetermined time frame.

Compounded Semiannually

Compounded semiannually refers to the process of calculating interest on a principal sum where the interest is added to the principal twice a year, causing it to grow at an accelerated rate.

Strip Bond

A debt security that pays no interest and is sold at a discount from its face value, with the investor receiving the bond's face value at maturity.

Compounded Semiannually

The process of applying interest to an investment or loan twice a year, resulting in compound growth.

Q4: When you retire 40 years from now,you

Q4: Which one of the following risk premiums

Q11: A wealthy benefactor just donated some money

Q27: Phone Home,Inc.is considering a new 6-year expansion

Q33: High Country Builders currently pays an annual

Q37: Stacy purchased a stock last year and

Q42: You are purchasing a 20-year,zero-coupon bond.The yield

Q43: Trish receives $450 on the first of

Q53: Phil can afford $200 a month for

Q91: You are considering two mutually exclusive projects