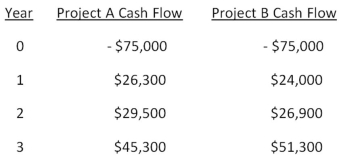

You are analyzing the following two mutually exclusive projects and have developed the following information.What is the crossover rate?

Definitions:

Zero-investment Portfolio

A portfolio that is constructed without requiring any initial capital, typically by taking long and short positions that offset each other.

Short and Long Positions

Short positions involve selling securities not owned with the hope of buying them back at a lower price, while long positions involve buying securities with the expectation that they will increase in value.

Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) is a theoretical framework used to determine the expected return on an investment, factoring in risk and the time value of money.

Security Market Line

The Security Market Line (SML) is a graphical representation in financial markets that depicts the expected rate of return of an investment as a function of its systematic, or market, risk, as measured by beta.

Q1: You need $25,000 today and have decided

Q3: Three years ago,Knox Glass purchased a machine

Q9: On June 1,you borrowed $220,000 to buy

Q11: Nelson Mfg.owns a manufacturing facility that is

Q22: The specified date on which the principal

Q53: You are considering the following two mutually

Q57: Which one of the following ratios identifies

Q83: Hollister & Hollister is considering a new

Q90: The Design Team just decided to save

Q98: The bonds issued by Stainless Tubs bear