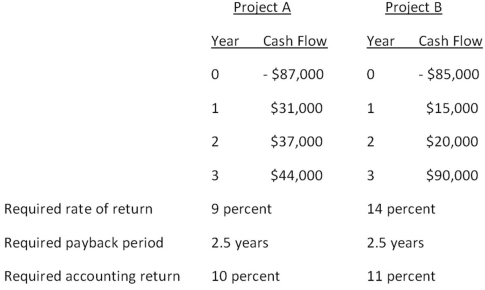

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on net present value analysis?

Should you accept or reject these projects based on net present value analysis?

Definitions:

Unemployment Rate

The segment of individuals in the labor force who are not in employment but are looking for jobs actively.

Opportunity Cost

The value of the best alternative forgone when a decision is made to pursue a particular action or resource allocation.

Capital Goods

Long-lasting goods that are used in the production of other goods or services, such as machinery, buildings, and equipment.

Consumer Goods

Goods purchased and used by consumers rather than manufacturers for producing other goods.

Q16: An ordinary annuity is best defined by

Q25: At an output level of 50,000 units,you

Q32: You are comparing two annuities with equal

Q57: The current book value of a fixed

Q60: An 8 percent corporate bond that pays

Q62: Which one of the following statements related

Q67: Which of the following are considered weaknesses

Q67: What is the model called that determines

Q92: You've observed the following returns on Crash-n-Burn

Q99: An individual on the floor of the