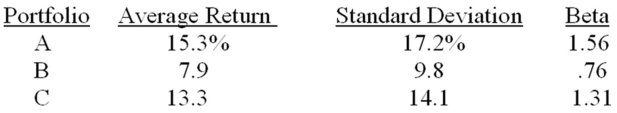

What is the Treynor ratio of a portfolio comprised of 25 percent portfolio A,35 percent portfolio B,and 40 percent portfolio C?  The risk-free rate is 3.6 percent and the market risk premium is 8.2 percent.

The risk-free rate is 3.6 percent and the market risk premium is 8.2 percent.

Definitions:

Firm Commitment Underwriting

A commitment by an underwriter to buy all the unsold shares of a public offering at an agreed-upon price, thus guaranteeing the issuer that the offering will raise a certain minimum amount of capital.

Spread

The difference between the buying and selling price of an asset or the difference between the bid and ask prices in trading.

IPO Underpriced

The phenomenon of an initial public offering (IPO) being priced below its market value, often leading to a significant first-day surge in stock price.

Issuer

An entity that offers securities for sale to finance its operations, such as a corporation or government.

Q4: Material nonpublic information is defined as any

Q18: Retail Specialties just announced that its Chief

Q30: A list of available option contracts and

Q41: A Treasury bond has a face value

Q49: The modified duration:<br>A)is equal to the Macaulay

Q58: Last year,you created an immunized portfolio with

Q58: Which one of the following will increase

Q63: A diversified portfolio has a beta of

Q75: Technical analysis is the study of which

Q77: Altoona Train stock increased from $18 a