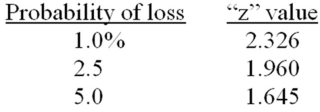

You have a portfolio which has an average return of 10.3 percent.In any given year,you have a 2.5 percent probability of earning either a zero or a negative annual return.What is the approximate standard deviation of your portfolio?

Definitions:

Conditioning Trial

An experimental setup in classical conditioning where a neutral stimulus is paired with an unconditioned stimulus until the neutral stimulus alone elicits a conditioned response.

Voluntary Action

An activity or action undertaken by an individual out of free will, without external compulsion or coercion.

Stimulus Generalization

A psychological phenomenon in which a response to a specific stimulus becomes associated with similar stimuli, causing the same response.

Stimulus Discrimination

Stimulus Discrimination is the learned ability to differentiate among similar stimuli and respond only to the actual stimulus linked to a positive or negative reinforcement.

Q3: You are advising several individual investors who

Q7: Pure discount bonds which are created by

Q22: What was the price per pound of

Q26: Which of the following correctly identifies the

Q28: Tony brags that his portfolio's rate of

Q42: A stock has a return of 16.9

Q51: How much option premium per share will

Q70: Pro forma financial statements are statements based

Q78: Which one of the following statements applies

Q91: If spot-futures parity exists for an index