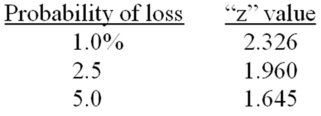

Lester has a portfolio with an average return of 12.8 percent and a standard deviation of 9.1 percent.He has a one percent probability of losing _____ percent or more in any given year.

Definitions:

SSR

Stands for Sum of Squares due to Regression, which quantifies the variation explained by the regression model, comparing the estimated values to the mean of the dependent variable.

SST

Total sum of squares in statistical analysis, representing the total variation in the observed data relative to the mean.

Multiple Linear Regression

A statistical technique that models the relationship between a dependent variable and two or more independent variables by fitting a linear equation to observed data.

Partial Regression Slope Coefficients

Quantitative measures in multiple regression models that represent the rate of change in the dependent variable for one-unit change in the predictor variable, holding other variables constant.

Q2: For the year,Widgets Manufacturing,Inc.increased its current accounts

Q4: A cash-settled option is defined as an

Q19: What is the area of finance called

Q19: Which one of the following inputs is

Q32: The increased cash flows into mutual funds

Q38: Which one of the following situations will

Q44: Which of the following will increase if

Q63: Laura has an average tax rate of

Q66: Which one of the following is the

Q75: A bond has a dollar value of