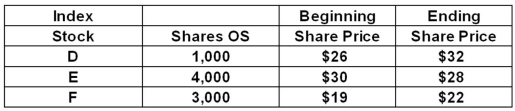

An index consists of the following securities and has an index divisor of 3.0.What is the price-weighted index return?

Definitions:

Expected Dividend

The projected payment a company is expected to distribute to its shareholders from its earnings.

Market Risk Premium

The market risk premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets.

Risk-Free Rate

The theoretical rate of return on an investment with no risk of financial loss, often represented by government bonds.

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates higher than market volatility, while a beta less than 1 indicates lower.

Q4: Given the following information,what is the value

Q9: The January effect:<br>A)does not occur in the

Q10: Last year,Kathy purchased 3 shares of stock

Q55: Which one of the following borrowers will

Q76: One year ago,you purchased 100 shares of

Q83: On August 8 of this year,Brent sold

Q89: Elizabeth short sold 400 shares of stock

Q91: A call option is an agreement that:<br>A)obligates

Q96: Alex invested $10,000 in a mutual fund

Q96: Which one of the following prices will