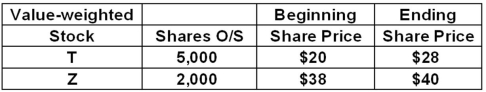

An index consists of the following securities.What is the value-weighted index return?

Definitions:

Expected Utility

A theory in economics that quantifies how choices are made with uncertainty, aimed at maximizing the satisfaction or benefit.

Risk-neutral

A characteristic of individuals or entities that exhibit indifference between choices with differing levels of risk, focusing solely on expected outcomes.

Expected Utility

A strategy in economics and game theory where individuals choose the option with the highest expected benefit, taking into account all future outcomes.

Risk-neutral

Refers to a mindset or condition where an individual or entity is indifferent to risk when making investment decisions, focusing instead on the potential returns without giving additional weight to the possibility of loss.

Q2: Which one of the following indicates the

Q37: Letter grades are most frequently assigned to

Q64: Jennifer believes that Northern Wine stock is

Q65: When a group of underwriters jointly work

Q69: Over the past five years,an investment produced

Q80: Blue Water Tours just paid an annual

Q84: Trading symbols for mutual funds end in

Q88: You recently purchased 100 shares of stock

Q93: The variable f<sub>1,1</sub> as used in the

Q126: Suppose drought destroys many millions of acres