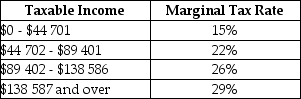

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the minimum rate of 15%?

Definitions:

Interactive Software

Computer programs that are designed to allow user interaction to perform certain tasks rather than just running a predefined sequence of operations.

Respondent Behavior

A type of behavior that occurs as an automatic response to a certain stimulus, often used in the context of classical conditioning.

Taxi Dancer

A paid dance partner in a partner dance who works for a dance hall or club.

Radio Corporation of America

A powerful company established in 1919 that played a pioneering role in the development and spread of radio broadcasting and television in the United States.

Q7: Refer to Figure 17-2.The net social benefit

Q33: Consider a small economy with 3 individuals.Individual

Q45: Consider a coal-fired electric-power plant that is

Q61: Refer to Figure 15-2.The market for financial

Q66: Refer to Figure 14-1.The two labour markets

Q89: If the annual rate of interest is

Q100: Which of the following correctly describes the

Q102: If nominal national income increased by 20%

Q113: In economics,the term "public good" refers to

Q128: If the government wants to ensure that