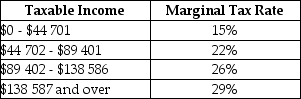

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

Definitions:

Obedience To Authority

A behavior exhibited by individuals who comply with commands or orders from those in a position of power, often studied in social psychology.

Electric Shock

A sudden discharge of electricity through a part of the body, causing injury or neurological disruption.

Utilitarian Organizations

Entities where people join primarily based on receiving wages or other material benefits in exchange for their efforts.

For-Profit

Describes businesses or organizations that operate primarily to generate profit for their owners or shareholders, as opposed to non-profit organizations.

Q1: Refer to Table 20-2.What is the value

Q1: A paper mill discharges chemicals into a

Q14: Consider two firms,A and B,that must engage

Q16: If the price index is P<sub>1</sub> in

Q36: Consider the investment component of GDP.The change

Q38: Suppose an income tax is levied in

Q46: The term "present value" refers to the<br>A)value

Q69: Under what circumstances would it be efficient

Q104: Suppose Y=400 and the government's net tax

Q123: Provincial laws that mandate a minimum drinking