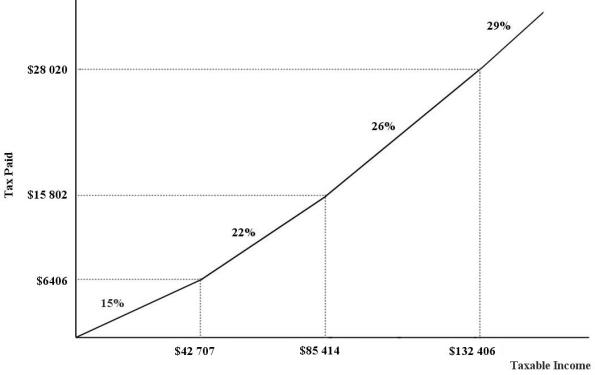

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

Definitions:

Psychosocial Theory

A theory formulated by Erik Erikson that proposes that individual psychological development occurs in eight predetermined stages, each stage marked by specific challenges and potential outcomes.

Dietary Restrictions

Limitations on one's diet, often based on allergies, health issues, or personal, ethical, or religious reasons.

Cardiac Function

The ability of the heart to pump blood effectively throughout the body, vital for maintaining circulatory health and overall bodily function.

Sexual Performance

An individual's ability to perform sexually, which can include factors such as libido, endurance, and satisfaction.

Q1: Which of the following roles of the

Q45: In macroeconomics,the term "national income" refers to<br>A)all

Q45: In 2015,the federal income-tax rate was graduated

Q58: The "value added" for an individual firm

Q60: Refer to Figure 18-3.Suppose that supply is

Q62: Refer to Figure 17-3.The socially optimal amount

Q77: Suppose a dairy farmer is considering the

Q82: When assessing a tax system,"vertical equity" refers

Q85: Suppose the unemployment rate is 8.5% and

Q101: Financial intermediaries are often the "middlemen" between