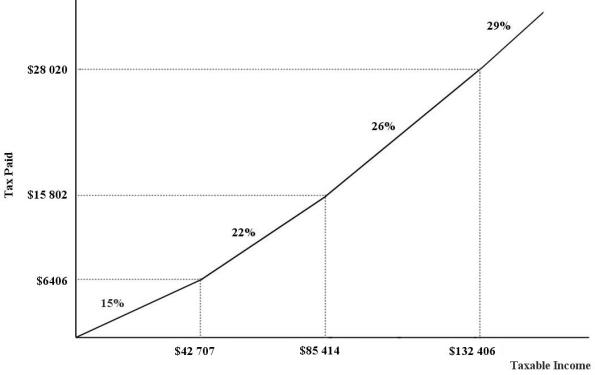

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $98 125 will pay $________ in income taxes.

Definitions:

New Product

An item or service recently developed or introduced to the market, offering new value to consumers.

Breakthrough

Refers to a significant and sudden advance or discovery that opens up new possibilities in a field of study, technology, or industry.

Continuous

An ongoing, uninterrupted process, action, or flow that does not have a clear beginning or end.

Product

Any item or service that is created through a process and is offered to the market to satisfy a need or want.

Q4: Refer to Figure 16-2.Suppose that the marginal

Q11: Two firms,A and B,are legally required to

Q66: A "poverty trap" refers to the situation

Q69: The consumption function is based on the

Q89: Suppose an employer and its employees enter

Q92: If typical firms in a competitive industry

Q92: Refer to Figure 17-5.Suppose each firm is

Q108: Refer to Table 17-1.Suppose a public authority

Q112: Suppose that real national income (Y)is equal

Q135: Consider the consumption function in a simple