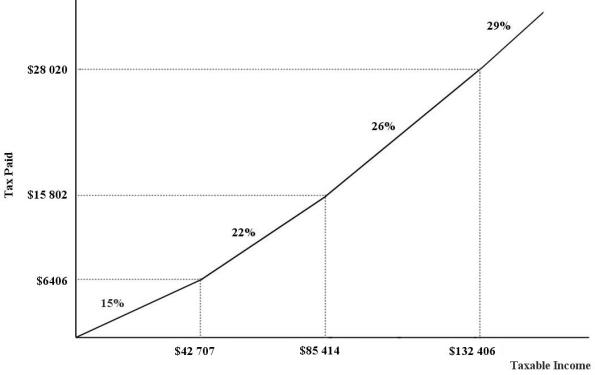

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.This income-tax system can be characterized as

Definitions:

Affirmation

Positive statements or actions that confirm one's abilities, qualities, or achievements, supporting personal growth and self-esteem.

Positive Message

Communications or statements that convey optimistic, constructive, or hopeful content.

Prosocial Development

Prosocial development refers to the process of becoming more inclined to behave in a way that benefits others, including behaviors like helping, sharing, and showing compassion.

Teaching Morals

The process of educating individuals, especially children, about values, ethical conduct, and the difference between right and wrong.

Q1: The Canadian government introduced the Tax-Free Savings

Q1: Which of the following roles of the

Q9: Consider the government's budget balance.Suppose G =

Q9: Governments continue to provide public support to

Q26: Refer to Table 19-1.In which years was

Q28: Consider a 10% excise tax that is

Q58: If the government's net tax rate increases,then

Q90: In order to determine the economy's real

Q105: A flu vaccine has an associated _

Q116: When studying income distribution,the Classical economists were