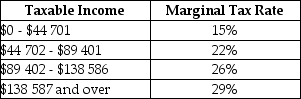

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the portion of earnings taxed at the maximum rate of 29%?

Definitions:

Cerebellum

A part of the brain located at the back of the skull, vital for coordinating movement and balance, and involved in learning motor behaviors.

Basal Ganglia

Nuclei at the base of the cerebrum involved in controlling motor functions.

Midbrain

A central part of the brainstem that plays a role in vision, hearing, motor control, sleep/wake, arousal, and temperature regulation.

Cerebral Cortex

The outer layer of the cerebrum in the brain, involved in high-level brain functions such as thought, emotion, reason, and language.

Q19: Unions currently represent _ employed workers in

Q25: The formula to calculate the present value

Q53: Suppose a dairy farmer is considering the

Q54: Which of the following environmental problems would

Q82: Consider the government's budget balance.Suppose G =

Q84: Consider an industry producing good X.The quantity

Q109: Consider a monopolist that is earning profits

Q110: Suppose Canada's exchange rate with the U.S.dollar

Q114: Refer to Figure 17-7.Suppose that a system

Q117: Government intervention in an effort to promote