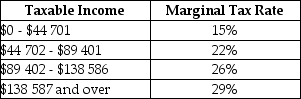

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the minimum rate of 15%?

Definitions:

Personality Traits

Enduring characteristics that describe an individual's behavior, such as openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Conscientiousness

A personality trait characterized by being thorough, careful, or vigilant; it implies a desire to do a task well, and to take obligations to others seriously.

Neuroticism

A personality trait characterized by anxiety, moodiness, worry, envy, and jealousy.

Openness to Experience

A personality trait that features the desire to explore new activities, ideas, and experiences.

Q1: Consider the simplest macro model with demand-determined

Q24: Labour-market discrimination,which keeps one group of workers

Q32: Refer to Figure 17-1.The equilibrium output that

Q33: Suppose a local meat packing company dumps

Q61: An emissions tax (imposed on each unit

Q69: A tax that takes a higher percentage

Q76: Refer to Figure 14-7.On the Lorenz curve

Q79: When we consider any future stream of

Q106: Wage differentials due to cross-worker differences in

Q112: Which of the following statements regarding housing