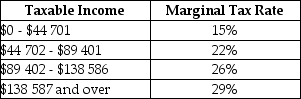

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

Definitions:

Odometer

An odometer is a device used to measure the distance traveled by a vehicle, typically recorded in miles or kilometers.

Duress

Duress involves compelling someone to act against their will by using threats, force, or coercion in the context of making a contract.

Mutual Mistake

A situation in legal contracts where all parties involved have misconceptions about a vital fact at the time of agreement.

Disclaimer

A statement that denies something, especially responsibility.

Q12: The excess burden of a tax reflects

Q34: In a Lorenz curve diagram,the size of

Q46: Which of the following is included in

Q47: The most important source of revenue for

Q60: Between 1995 and 2011,Canada's greenhouse gas emissions

Q62: Refer to Figure 16-4.Suppose the government provides

Q71: Refer to Table 20-8.The nominal Gross Domestic

Q98: Consider a simple macro model with a

Q115: Refer to Table 20-8.The implicit GDP deflator

Q135: Consider the consumption function in a simple