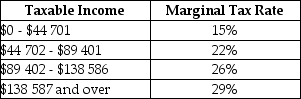

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 26%?

Definitions:

$20 Per Month

A fixed sum of money that is paid or received every month, often used in financial agreements or subscriptions.

Budget Line

A visual depiction of every potential pairing of two items that can be bought within a certain budget at constant prices.

Increase In Income

A rise in the amount of money earned or received by an individual or within an economy over a specific period.

Horizontal Axis

In a graph or chart, the x-axis, which typically represents the independent variable or time period.

Q4: The efficiency argument for government provision of

Q8: Canada's unemployment rate has been as low

Q21: Refer to Figure 17-4.Suppose the government requires

Q35: Refer to Figure 16-1.Suppose that the perfectly

Q43: On a graph of a consumption function,what

Q48: The total investment that occurs in the

Q52: Refer to Figure 16-2.Suppose that the marginal

Q89: Consider the following news headline: "Canadian business

Q105: Suppose there is a competitive market for

Q112: Suppose that real national income (Y)is equal