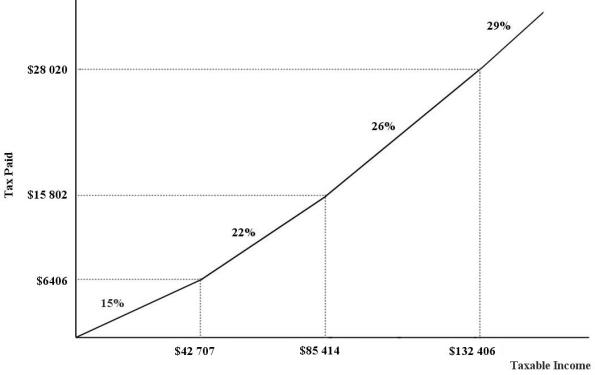

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

Definitions:

Implicit Costs

Expenses that are not directly paid for or incurred in cash, representing the opportunity cost of using resources owned by the business.

International Migrants

Individuals who move from their country of origin to another country, aiming to settle temporarily or permanently in the new country.

Labor Immigration

The movement of people from one country to another primarily for employment opportunities.

Destination Country

A country to which people are moving or goods are being shipped.

Q2: Consider the simplest macro model with a

Q3: In national-income accounting,the concept of net domestic

Q4: Consider a simple macro model with demand-determined

Q32: Refer to Figure 17-1.The equilibrium output that

Q43: Real GDP measures<br>A)the constant-dollar value of the

Q55: Researchers are trying to identify the causes

Q66: Refer to Figure 14-1.The two labour markets

Q100: When designing a policy to reduce polluting

Q103: When calculating GDP from the expenditure side,which

Q118: Suppose a firm producing roof shingles imposes